When shopping for bullion coins you may have encountered something called rounds, and been confused about the term and what it means. Similarly you may have encountered medallions and wondered how they differ from coins. The basic difference between a coin and a round is that a coin is officially minted and is legal tender, while a round is not legal tender, and is usually privately minted. In its most standard usage, the word "medallion" refers to a metal piece that is, similarly to a round, not legal tender. But the word "medallion" tends to be used for a lot of commemorative coins aimed at collectors, whereas "round" tends to be used for bullion coins aimed at investors.

An example of a bullion coin is an 1 oz. American gold eagle or American silver eagle, since they are legal tender and officially minted by the US Mint.

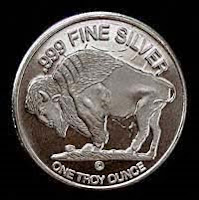

An example of a silver round is this North West Territories (NWT) Mint one ounce silver round. I can't give you an example of a gold round, because even though I know they exist they are rare. Gold is so much more valuable than silver that investors prefer the safety of officially-minted and well-recognized coins.

An example of a gold medallion is this Winston Churchill commemorative medallion.

It should be noted that while the above definitions are the most common specific definitons, the word "coin" is often used in a general sense to refer to all

coin-shaped items. But a true "coin" will have a clearly marked face value in the currency of its country of mintage. For example, a 1 oz American Gold Eagle has a face value of $50. A generic silver round will not have a face value indicated, but just the precious metals weight and purity. For example, "1 troy ounce .999 fine silver" as printed on the NWT silver round. Commemorative medallions sometimes don't even have the precious metal content and purity written, so to determine that information you need an appraisal or certificate of authenticity.

Are there any advantages of coins over rounds and medallions?

Well, as mentioned before, officially-minted coins are easier to trust and feel secure with, since you know that your bullion purchase was made in accordance with all laws and regulations. In addition, officially minted coins, especially major ones like Maple Leaves, American Eagles, Krugerands and the like, are highly recognizeable and very liquid because of their visibility. The downside of officially minted bullion coins is that they carry a relatively high premium, partly because of higher demand but partly because they are not sold directly from the mint to individual investors, they first go through middle men. The US Mint for example sells its coins to distributors called "Authorized Purchasers". The authorized purchasers then mark them up and sell them to bullion retailers, who also mark them up before selling them to you. So in the case of an American silver eagle, you pay a significant premium over the spot price of silver to pay for the operations of distributor and bullion retailer.

In the case of a silver round, you can order directly from the mint, or retailers order directly from a mint, so you pay a lower premium over the spot price. This difference in premium can be quite hefty, for example the current spot price of silver is around $13.50, but an officially minted 1 oz bullion coin will probably command at least $18 while a silver round could be bought for as little as $15. If you are buying in large quantities, silver rounds could help you accumulate a significantly larger stack. When selling your silver rounds, they will of course command a lower price than officially minted bullion, but you should be able to get at least the current spot price. If you are living somewhere where your round is not recognized (or in my case, the silver ingots I bought in Japan), then you may have to sell your metal to a melter at less than spot. But you can always sell back to the mint you bought it from, at a small price spread. So basically, while officially-minted coins have the benefit of immediate recognizability and liquidity, rounds are more of a direct investment in physical bullion. When it comes to silver I personally prefer to hold about 1/3 of my stack in widely recognized bullion coins, and 2/3 in silver rounds. That way I have some guaranteed liquidity for emergencies, but still have the benefit of buying at lower premium rates.

As for medallions, if they are not in high demand then they can be treated like a round. But if they are sought-after by collectors then they will likely command

a numismatic premium well beyond the spot price of gold or silver. I personally stay away from almost all numismatic coins because I'm much more of an investor than a collector. But if I find a medallion at close to the spot price, I might buy it. The problem is making sure that you know its constituent metals, weight, and purity which are not always indicated.

A note of caution: there are a large number of rounds and medallions that are replicas of officially-minted coins. They are legally allowed to reproduce the images of officially minted coins, but they can not be the same size and dimensions as the original. You may encounter some 1 pound or 1/2 pound "American Eagles" for example (see the example below). If you buy them from a legitimite private mint, then you can trust that their precious metals content is genuine. The weight and purity should be written on the round. Please be aware that such replicas exist, and understand what you are buying. Some of the private mints have names that sound official, like "Washington Mint" or "American Mint", so novice investors may assume they are buying an official proof coin. And there are vendors, especially on Ebay, who will avoid telling you that these are replicas. Be sure to examine the pieces you are interested in buying, check for a face value, and if the coin is of an unusual size, do your research to see if such a large version was ever officially minted. You can quickly find out a lot of this information online, as long as you know to look.